Insights

The why is as important as the what in understanding customers

It’s not exactly controversial to say that understanding your customers is good practice. Customer analytics is a well-established discipline across industries. Whilst it was once the preserve of major retailers with significant funds to invest in loyalty schemes, data warehouses and specialists, the rise of technology and the identifiable nature of digital now allows everyone to capture and mine information about their visitors, users and buyers.

Add in the increasing accessibility of data science, machine learning, AI and whichever other buzzwords I can cram into this sentence to boost our SEO, and it becomes a no-brainer to understand and predict customer behaviour. Customer analytics, when done well, is a rare example of a mutually beneficial arrangement for consumers and brands (putting aside the faintly nefarious ad practices).

The cycle of data

Used properly, a deep and broad knowledge of customer habits, needs and motivations helps create a virtuous circle: Google knows what I’m going to search for based on my prior behaviour, I find search easier to use, I use search more, Google gathers more information, repeat. Amazon knows what its customers are buying and sets up its warehouses accordingly for rapid delivery. I get my latest impulse purchase 12 hours after ordering. I use Amazon more. Repeat.

It’s no surprise that companies everywhere emulate these approaches, yet few achieve real success with customer data. The reason comes down to an age-old problem: for many organisations, customer data can describe what is happening, but it can’t explain why.

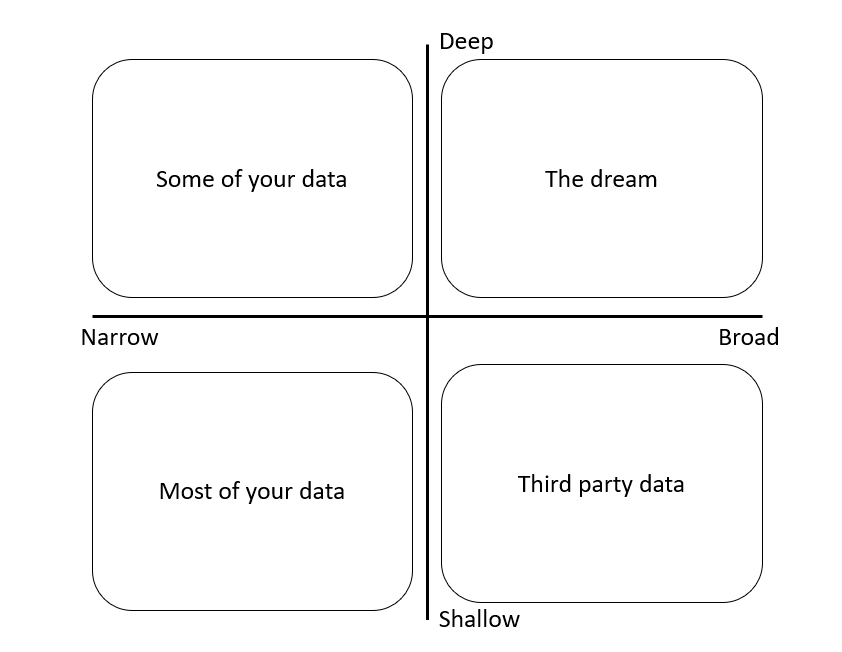

Customer data can be described on this highly scientific two way axis:

Google, Amazon, Facebook and friends win because their data is both deep, and broad. They have dizzyingly deep behavioural data — lots of touchpoints on a single area, across a broad range of behaviours, for a massive and high frequency user base. They have deep enough data to understand their users’ actions, the what, and broad enough data to understand the motivations driving that behaviour, the why. They can and do use this knowledge to great effect to retain and grow their customer bases and stay on top.

Most of us, sadly, are not in that boat. How can we get close?

Deep vs. broad

Imagine your favourite fashion retailer. How often do you visit them? Once a month? Once a quarter? They might see you 12 times a year, even if you’re among their best customers. If you’re a regular customer they’ll have the deepest data; they’ll know your style preferences, size, promotional propensity, but their data will be very narrow. It’ll only tell them about your fashion purchases, and probably not all of them. It won’t tell them much at all about your other motivations, interests and preferences more generally. It won’t tell them how to communicate with you and people like you. It won’t tell them why you picked their brand in the first place.

If you think about it, this data is very limited, but it’s also the best most companies have. In fact, the majority of customer data will be both narrow and shallow. Let’s offer a reverent nod to Vilfredo Pareto and his eponymous curve, and assume a brand might have ‘good’ data on 20% of their customers at best. The remaining 80% form a long tail who are seen on vanishingly rare occasions, once a year perhaps. Good luck trying to pull anything useful from it.

Two customers who look identical from your sparse transaction data can suddenly look completely different when broad third party data is overlaid, and paths to action become clearer.

Most consumer-facing companies face this issue. If our hypothetical fashion outlet has it tough, pity the car manufacturer, the travel company, the hotel chain, the luxury brand who may only see even their better customers once every few years.

The impact of narrow and shallow data will be familiar to anyone who has sat through an insight presentation. The team present an array of killer stats and key insights from the data, weaved into an engaging story. They turn to the room for feedback, and their work is mortally wounded by the immortal words:

“So what?”

When customer insight lacks breadth as well as depth, this is a common result. There is a tendency to focus on more metrics and more science in search of meaning, but the findings don’t often change. Without the broader context of customers, ‘so what’ is almost inevitable.

Building a bigger picture

To get true value from customer data, companies need to invest in broad data to complement their own knowledge, and this is where third party data can be extremely useful. It can add the why to the what by adding contextual breadth and colour to customer knowledge. It helps marketers get closer to real, customer-driven activation. Two customers who look identical from your sparse transaction data can suddenly look completely different when broad third party data is overlaid, and paths to action become clearer. Unfortunately, a lot of third party data is reliant on outdated data and approaches, so it doesn’t add the clarity that marketers need.

At Starcount, we’re re-thinking this problem. Having had decades of experience at the sharp end of ‘so what’ with first party customer data, we understand innately that better third party data sources are needed. We’ve developed a modern approach to broad data, using the latest digital data to go beyond what’s available in the market and uncover granular, constantly updating customer motivations for millions of global consumers based on trustworthy, safe and permissioned data sources.

With our proprietary approach, we’ve been able to help clients understand the broad motivations that power their customer data and drive purchase. From this, clients can differentiate their customers in a much more effective way; even the long tail who rarely visit — and target messaging to them that is much more relevant and resonant.

The results speak for themselves: for example in a recent campaign where our approach was used, a client saw a 400% increase in email response and bookings vs their standard approach, with little extra effort. This is the power of adding high quality broad data to deep first party data.

When it comes to customer data, understanding what is great, but knowing why is absolutely key to driving the best results.

This piece was devised and written by Mark Burton, Head of Product Activation at Starcount.