Insights

Banking on data: Social insight in the financial services industry

The last few years have seen multiple revolutions in the financial services industry and in the way consumers choose to bank. With advancing technology, new regulations, Open Banking and new understandings of how to use data, new players have arrived on the scene, throwing the once dominant positions of the traditional high street banks into uncertainty.

These disruptors have taken various forms, from digital-only banks to democratised payment services that cut the traditional players out. The result is a financial services industry that is more competitive and ambiguous than ever before, as each player is trying to devise ways to grow their share of the market.

What will decide this race? Data; more importantly what data and how it is used. Already, challenger banks like Monzo and Starling have shown that they are prepared to use customer data in ways that the established banks had not considered, making banking more personalised for a new customer in a new age.

But that won’t be enough. We are now entering an age where staying ahead means understanding your customers like never before, their passions, motivations and mindsets, in order to really offer a service that works for each and every individual customer.

So, how does a brand do this?

Social clustering

Enter social data – or, to be more precise, Starcount’s unique method of ‘social clustering’. We analyse the passions and likes of social media users and cluster them together into different segments based on similar passions, using our pioneering platform, The Observatory. This method is different to, and much more effective than, ‘social listening’ (if you would like to understand more about the differences and why social clustering works better, read our guide here).

Using The Observatory, we can identify the audiences of individual banks to find out what makes each different and, conversely, what similarities they might share, insight that can help a bank with everything from how to talk to different customers, to where its place in the market is, relative to the competition.

A useful place to start is a comparison between the old and the new, traditional versus unconventional.

Lloyds vs Monzo

Immediately, it is clear that we are dealing with two very different audiences, most clearly illustrated by age. While Lloyds takes the bigger share of the older fans, it is Monzo that dominates in the 18-24 age range, with 51.9% of the audience, an element that is to be expected.

If we dig a little deeper, these initial observations are confirmed. The Lloyds audience are far more interested in brands than they are in influencers, as brands make up 78.9%, while influencers take up less than a per cent. Meanwhile, nearly 40% of Monzo’s audience are interested in influencers, confirming the current millennial interest in influencer marketing.

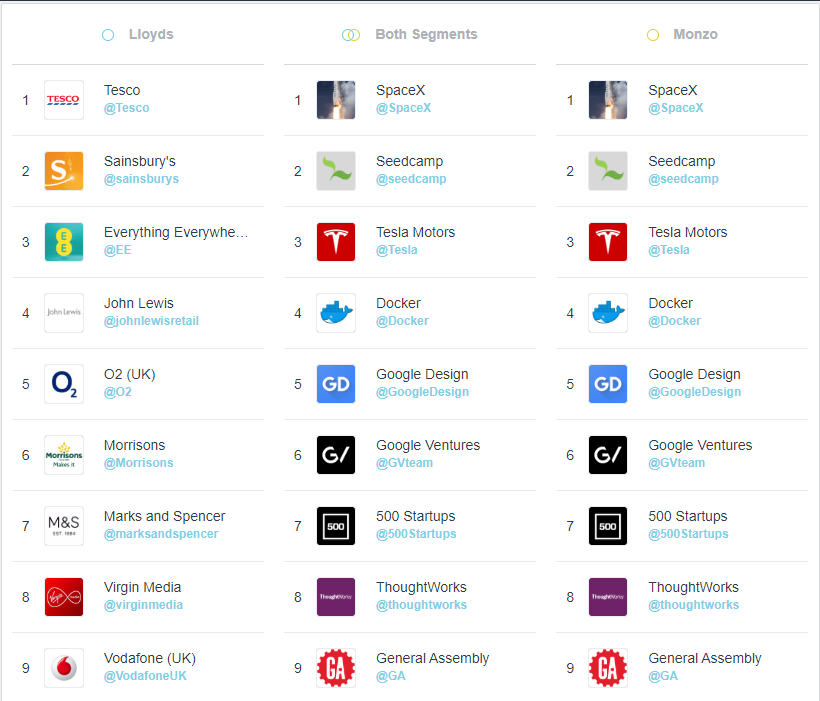

The top passions, too, diverge wildly: while Lloyds fans are passionate about Finance and Investment, Personal Finance and Insurance, Phones and Communication and Economics, the Monzo audience are more interested in Computing & Software, General Technology, Entrepreneurships & Start Ups and General Science.

Top brands continue to reflect the differences. The Lloyds audience are fans of Tesco, John Lewis, Marks & Spencer and British Airways. On the other hand, Monzo followers are keener on SpaceX, Tesla, Google Design and Seedcamp (a tech seed fund).

While some might have guessed that these two audiences would be wildly different, based on how each bank operates, this information is extremely useful in showcasing just what customers of each bank are passionate about, giving us a glimpse into how they live their lives and showcasing how best to talk to them, as well as find others like them.

Lloyds vs RBS

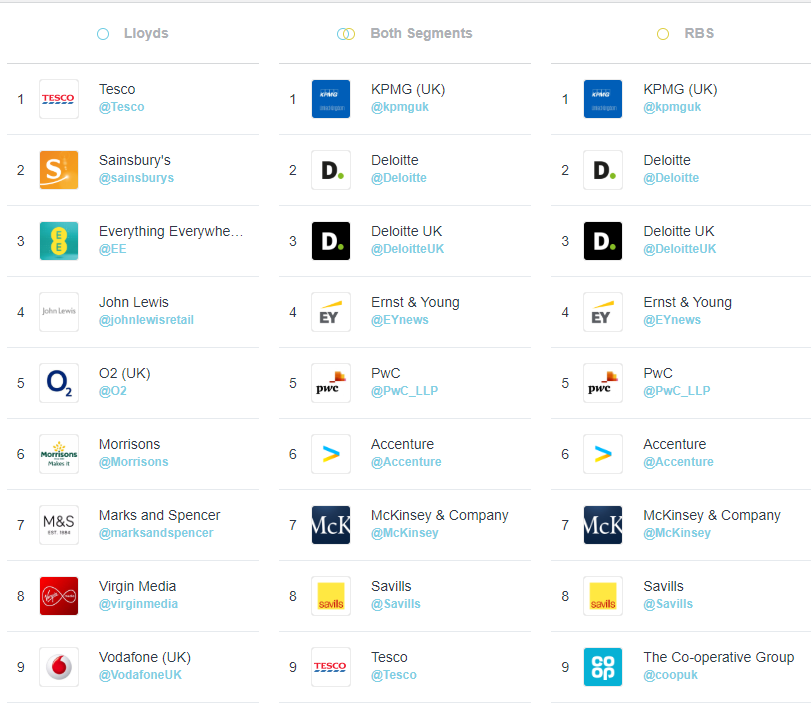

But what about a more suited comparison? Can we garner any useful insight into the audiences of Lloyds and RBS, both similar in style and structure? At first glance, they seem almost identical. For example, they hold a similar male to female ratio of around 60% male audience; fans of both also share a far more dominant passion for brands than for influencers.

Looking at age reveals a little more. Lloyds dominates the 18-24-year-olds, while RBS has a slightly bigger share among 25-34-year-olds and dominates among 35-44-year olds.

However, digging a little deeper and the real differences begin to show. The top brands for RBS fans are Deloitte, Accenture, Savills and The Co-Operative Group, while Lloyds fans remain the same as noted in the example above, focused more on retailers (Tesco, Sainsbury’s, John Lewis, Marks & Spencer).

Furthermore, while the top media titles for RBS fans are BBC Business, the FT Finance News and Economist Business, fans of Lloyds are more interested in Sky, The Guardian and Reuters.

This comparison serves as a useful illustration that even two banks whose audiences might seem identical on first appearance, can be radically different. More importantly, this insight highlights that both these banks should understand that they need to talk to different customers in different ways if they hope to retain, as well as grow, their share of the market.

Finally, what of the newer players? A useful example is provided by Metro Bank, which emerged as one of the disruptors, but has found itself jostling towards the realm of the traditional names. Whether this has translated into its audience, however, can be seen by a comparison with Starling, another new digital-only bank and one of the major disruptors of the financial services industry.

Metro vs Starling

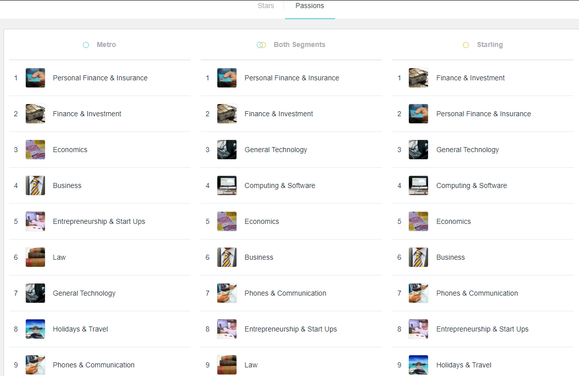

The passions of Metro fans illustrate a mix of those shared by fans of Monzo and by fans of Lloyds, including Personal Finance & Insurance (Lloyds) and Finance & Investment (Lloyds), but also Entrepreneurship & Start Ups (Monzo) and General Technology (Monzo). Meanwhile, Starling fans prioritise General Technology, Computing & Software, but also Holidays & Travel, a passion that was absent from the top list of Monzo passions and an example of a possible differentiator between these two challenger banks.

The top brands for fans of Starling are also similar to those of the Monzo audience, such as Seedcamp, Google Ventures and Tesla. The top brands for Metro fans, however, further serve to illustrate the hybridity of its audience. They include Deloitte and Savills – just as with RBS – but also Mortgage Brain, Council of Mortgage Lenders and the Mortgage Advice Bureau, reflecting brands that did not emerge with the other examples, and also an interest in mortgage-related activity.

This interest in mortgage-related subjects continues when we look at the top media titles for Metro fans, which are Mortgage Finance News, Mortgage Solutions and Mortgage Strategy.

It is insight that helps to underline the position that Metro banks finds itself in, within the market, and is a useful example to illustrate how understanding who your customers are can help you to position yourself against your competitors.

The key to the future

All of this is only a glimpse into the passions and motivations of the followers of each bank. However, it helps to underline how understanding who your customer is can radically re-define your business strategy. For an industry that has prided itself on always trying to make its services work for the customer, both in decades gone and in more recent years, understanding how social data can revolutionise that process is the key to the future of banking.